If local brick & mortar establishments are going to weather Coronavirus, they must work backward from consumer behavior and commercial real estate realities. Plans that suggest we jump into a time machine and return to retail and restaurant circa 2019, but with warning signs, plexiglass, PPE, and plastic sheeting, don’t understand a thing about how small, in-person transactional business actually works.

The ground floor commercial ecosystem consists primarily of retail, restaurant, and personal service businesses (salons, spas, etc). These brick & mortar concerns require customers to spend in-person time in a physical space. The best of these businesses are multi-sensory and encourage product interaction. (In fact, the more senses engaged, the more successful a brick & mortar business usually is.)

The characteristics that customers value from these in-person businesses has been evolving over the last few decades. Now, American consumers are choosing to invest their personal time in ways that are almost trending back to the 1900s. We have the Internet instead of the Sears catalog. We increasingly have commodities delivered. And, we choose to spend our personal time in spaces and with businesses that offer a combination of these four things:

- Great physical experiences.

- Personal customer service.

- Unique curation. (products, services, etc.)

- Expertise.

Another way of looking at it: fewer and fewer people want to be their own personal delivery vehicle, driving to a distributed network of stores and services all over the city, or even all over the Internet.

If we want to save as many of small, beloved businesses as possible, there are three key steps we need to take, which require combined action from the public sector, from property owners, and from businesses. You will notice that these steps reflect real estate realities and the customer preferences mentioned above.

Here are the steps and who has primary ownership over those steps:

- PERCENTAGE RENT LEASES (Property Owners)

- SUBSIDIZED LOCAL DELIVERY COOPERATIVE (Public Sector/Business Owners)

- EXTERIOR COMMERCE (Public Sector/Business Owners)

PERCENTAGE RENT LEASES

Rent per square foot is tied to sales per square foot. Low sales districts have low rent. High sales districts have high rent. There are almost no brick & mortar businesses projecting that they will be doing anywhere near their 2019 sales levels anytime soon (unless there is a cure/treatment for Coronavirus). Most small, local businesses I talk to are hoping to be at 25% to 50% of 2019 sales levels after a month or two of opening. That means they are only going to be able to afford 25% to 50% of 2019 rent.

Here is the hard truth: landlords that require small businesses to pay 2019 rent between opening and the end of the year will most likely lose ALL of their tenants. And, each and every “juice the economy” plan being rolled out by governors will not work at 2019 rent levels either.

Luckily, there is a leasing tool that works really well for this situation. It is a type of lease called a percentage rent lease. In these agreements, tenants agree to pay a certain percentage of their sales in rent, sometimes with a floor or a ceiling. Instituting this type of sliding scale rent between opening and the end of 2020 is beneficial for landlords and tenants for several reasons:

- It will keep space occupied in a very down market for landlords.

- It is a period of time that will help us establish a new normal for sales per square foot through typical high seasons: summer, back-to-school, and Christmas.

- It allows businesses to be entrepreneurial, building the new revenue streams and approaches they will need to survive.

- It will include data from future breakouts, from micro hot spots to bigger outbreaks that coincide with flu season.

SUBSIDIZED LOCAL DELIVERY COOPERATIVE

We are training consumers right now to order online and take delivery of products that many have been resistant to in the past, such as groceries. If we are going to help local business compete with Internet vendors and with Amazon, the best thing that cities and towns can do in terms of local economic development is to fund the creation of local delivery cooperatives that can move products from local businesses to local residents.

(Notice, I am not talking about the delivery of on-demand prepared food. Honestly, outside of very dense places, it’s not good for the planet, nor is it sustainable long-term from a cost perspective, to have restaurants preparing ramen and having someone like Uber Eats drive it 30 minutes away. Having said that, this model could easily be used for pre-ordered prepared food, delivered at a scheduled time.)

A delivery cooperative could be started by focusing on first connecting local businesses with their local trade area. It could easily be a branded electric cargo bike-based approach. This service should be used to reinforce old school personal and direct relationships between vendors and customers. Going back to the list above:

Great physical experiences. If the bike is attractive, the branding distinct, delivery packaging eco-friendly, then every single person who gets something delivered locally is going to get a huge dopamine hit each time this bike pulls up and delivers something even FASTER than Amazon! Shoppers will feel sooooooooo good for using this service. And seriously, that a huge part of brick & mortar business… dopamine hits.

Personal customer service. We want to start using delivery to reinforce relationships. It’s not just about the internet. You want your customers to pick up the phone and order a new snazzy shirt and set of earrings so you look “newscaster on the top” during your Zoom calls.

Unique Curation. Your salon could easily deliver the hair care products you need to keep your curls rocking!

Expertise. I don’t want to look at every type of degreaser to scrape adhesive off of windows. I just want to talk to my local hardware store, ask what I should use, and have them deliver it! That would be awesome.

This is sustainable. This decreases driving. This creates connection and trust between local vendors and customers, which is what local retail is about. This gets local into the delivery model in a way that is appropriate to small brick & mortar businesses. And, it contributes to the future success of these businesses, post COVID. (Remember, Amazon is able to massively subsidize their product operations with the profits from their IT behemoth, Amazon Web Services.)

EXTERIOR COMMERCE

I was reading through a governor’s draft list of guidelines for retail and restaurant openings in the age of COVID, and what was described was such a ghastly environment, I don’t think even the most talented retailer would be able to lure someone to impulse purchase something!

Seriously. Food is love. It’s communion. It’s family. It’s connection. There is nothing we hate more than an empty restaurant, or a half empty restaurant. Now imagine a half empty restaurant, filled with staff wearing masks, the smell of bleach wafting up to the HVAC ducts from constant disinfecting, you can’t hear your waiter through their mask, and there are hand sanitizer stations and information signage everywhere telling you all of the things they are doing to keep you safe. Meanwhile, none of the customers will be wearing masks, because they have to eat.

What this describes is an environment saying, “You really shouldn’t be here, it’s not safe.” This is not an environment conducive to driving repeat business. Nor does it make customers happy. Nor is it a place that makes me want to spend money. In short, this plan is a money losing nightmare. It’s not meeting customers where they want to be. It’s not giving them a great experience.

Or imagine a little 600 SF boutique with one other customer in the store. Even that will feel too close to maintain social distancing. Perhaps here, staff is wearing a mask, but the customer isn’t, and that customer is flitting around, trying to touch everything. Products are behind glass and under plastic. I can see, but I can’t touch. I have to ask staff to try something on. Hmmmm, again, not really the experience that makes people part with their hard earned cash.

Bottom line, you have to work backward from what customers want. Right now, most people across both parties are not super excited about reopening. They are not super excited about being indoors with a bunch of other people, especially since much of what is known right now seems to show that it is prolonged indoor exposure to other people that is the biggest spreader of COVID.

So we need to change our brick and mortar interactions to an exterior commerce model that reflects the safety of employees and customers.

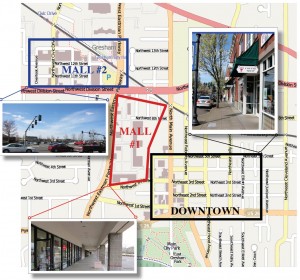

Two to three days a week, streets should close down in commercial districts and make exterior commerce available to locals. This is not a street fair. It’s a set, regular time where restaurants, stores, salons and others bring their services outside. And, if we reclaim the streets, we have room to make it cool, fun, safe, and SOCIALLY DISTANCED in a way we cannot do with interior commerce.

Every one of these districts should also have a pick-up concierge service during street closures where you customers can order items ahead, and pick them up in one place on the street whether you are walking, biking, or driving.

For larger cities, to prevent crowding, you have to ensure these closures are held on a regular rolling basis everywhere in the city, so all neighborhoods have regular access to exterior in-person commerce opportunities.

Some specific thoughts for restaurant, retail, and service are shown below:

Restaurant. I very much worry we are putting waitstaff and customers at unnecessary risk with any sort of typical indoor dining model. I strongly recommend exterior counter service and/or pre-order and pick up. Then people can take their food and eat at any of the socially distanced tables. We are really not in a position to offer table service as far as I’m concerned.

Retail. I am inspired by downtown El Paso and it’s charming district right on the border. The product outside is for interacting with/display. It’s where you decide what to buy. Then you ask the vendor for what you want to purchase, and he fetches that from inside the store. Much of the commerce/shopping happens outside. Thinking about merchandising that will allow for self guided discovery (how Americans shop) with more vendor assistance than is typical for us will be key.

Service. This is the toughest one, and it will require some imagination, but it can happen. Heck, I’ve seen people getting tattooed in public at a Comic Con. And, vacationers get massages in outdoor cabanas in Hawaii. There is a way to make this happen!

District street closures can restrict entry if it gets too crowded, or reserve timed entry.

FINAL THOUGHTS

The last thing I want to say is that time is of the essence. As my father-in-law the retired investment banker put it: “I call it a crisis because timely action/resolution is important. A lot of human and business damage can occur if ‘help’ arrives late.”

We can’t afford to arrive late. The private and public sector must work together to make this happen if we want business to be able to roll with the punches that are coming over the next 18 to 24 months. It requires lenders to give a break to landlords so they can offer percentage rent leases. It requires the public sector to close some streets and use economic development money to start hyper local delivery services. And, it requires the brick & mortar business owners to do what they do best: reinvent! So let’s give them the space, time, and financial breathing room they need!

{ 0 comments }